CONTACT US

Please enter your name.

Please enter alphabets only for Name.

Please enter Organization.

Please enter valid email id.

Please enter Phone number.

Please enter numeric only for Phone number.

Please enter your name.

Please enter alphabets only for Name.

Please enter Organization.

Please enter valid email id.

Please enter Phone number.

Please enter numeric only for Phone number.

By Vidur Kaul On 9 Nov 2021

Introduction

With increasing competition, insurers need to improve their competitive advantage by being more agile and dynamic with consumer behavior factors. Pricing is one factor that significantly influences consumer behavior, and thus insurers must turn to technology & data that help them act upon changes in the market in real-time. Big data, the Internet of Things, and predictive data analysis tools are giving insurance companies an advanced and broad ability to design usage-based and other innovative pricing models. With the right data strategy, insurers can deploy pricing dynamically that aligns with their customer expectations.

Modern Approach to Pricing

The Covid-19 pandemic has been a significant life change for consumers worldwide, and thus they are likely to tilt towards an insurer that provides personalized options. Dynamic pricing models which respond to changes in factors affecting consumer demand are the need of the hour for insurance companies. Traditionally, arriving at pricing has been quite time-consuming due to siloed data across systems. Also, this process has lacked the real-time intelligence needed to hit the consumer at the right time. The pricing calculations have generally included costs incurred historically in the payment of claims and the ability of the insurer to underwrite competitively. This approach has failed to factor in the price elasticity of the consumer at different price points, given changes in other factors.

Predicting Price Elasticity & Consumer Behavior

Below are some of the examples to better predict & understand consumer behavior & price elasticity:

As more and more consumers buy insurance online, insurers have gained greater access to the customers’ behavior data. Also, it is essential to factor in the most recent consumer behavior data and not just rely on the past/historical data to better predict future demands and price elasticity.

Optimize Insurance Pricing

The challenges that insurance companies face is to fine-tune the price in a way that is high enough to cover potential risk yet low enough to attract customers. An ideal pricing strategy should aim to optimize costs to balance customer conversion rates with the overall profitability. This depends upon the company’s overall business strategy as it may want to maximize customer conversion rates while maintaining overall profitability and vice versa. Also, optimizing pricing could be an activity to be undertaken at the overall customer level or segment level. Example – Rather than decreasing the overall premium level for all customers, it might make more sense to target specific market segments with higher growth potential. Sophisticated price optimization techniques like predictive modeling, impact analysis, “what-if” scenarios that analyze hundreds of different pricing options to increase rating accuracy, customer retention & profits are the need of the hour. Understanding price sensitivities at the individual policyholder level is critical, and thus the models should assist managers in coming up with a rate change for each policyholder that maximizes either profitability or conversion rates depending upon the company strategy.

Analysis of both policy attributes in combination with consumer attributes deliver insights that should drive an insurers pricing strategy.

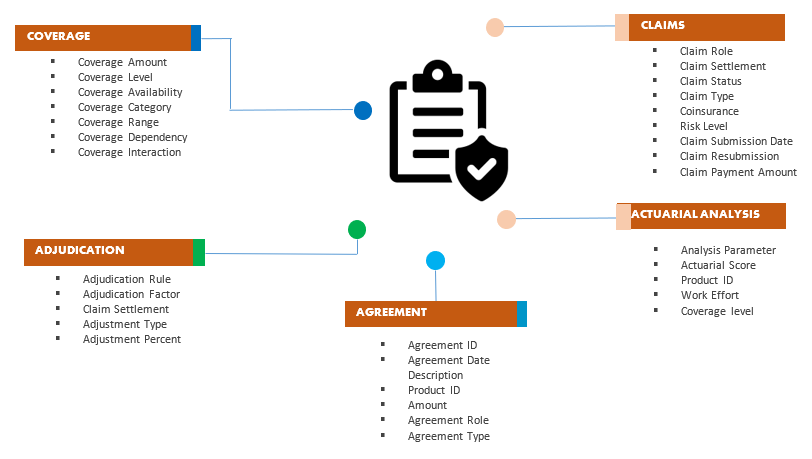

Illustrative Single View of an Insurance Policy

Illustrative Single View of the Customer (Insured) for Personalized Quotes

Note: Personal customer data should be collected adhering to data regulation. For example, in the case of GDPR regulations, insurers should provide clients with a choice and not an obligation to share data for a quote. The younger generation has shown less resistance to sharing their personal information if there is some value in return.

Unlock Business Value

In summary,

COVID-19 has put substantial pressure on the global economy and insurance industry. It bought a considerable change in consumers’ perception, as consumers are shifting towards more personalized options regarding pricing. The insurers need to find ways to improve their competitive advantage by being more attentive towards consumers factors. And, pricing is one such factor. Insurers who do not recognize this factor and fail to pursue and adopt new pricing models will play a guessing game, further diminishing their pricing capabilities. Those insurers will quickly lose the competitive edge to rivals that better understand what is driving their clients’ needs and willingness to pay—and as such, can design more attractive propositions at lower prices or higher margins at the same prices.

There are vast data opportunities for insurance companies to explore and exploit, provided; insurers can devote their time to focus on priorities such as data governance and data standardization enabling a successful implementation of Data Models and Data Lake capabilities.

When these pieces are sufficiently mature, data will serve as an essential factor in how decisions get made and processes get executed in each business and provide for a more competitive edge in the market.

No related posts.

is a Senior Business Analyst, Digital Business Services & Analytics at Happiest Minds. With a total experience of 8 years in Business Analysis he specialises in Presales Solutioning & Product Management for Insurance, Investment Banking, CPG, eCommerce, and Market Research clients. He has a keen interest in Data & Analytics solutions and has worked on several Data engineering (DWH, MDM) & Data Science (Chatbot, NLP, Augmented Search, Visualization) related projects. He practices design thinking techniques for better problem solving

In his free time, he likes playing tennis, attending food & music festivals and watching news.

Vidur Kaul

is a Senior Business Analyst, Digital Business Services & Analytics at Happiest Minds. With a total experience of 8 years in Business Analysis he specialises in Presales Solutioning & Product Management for Insurance, Investment Banking, CPG, eCommerce, and Market Research clients. He has a keen interest in Data & Analytics solutions and has worked on several Data engineering (DWH, MDM) & Data Science (Chatbot, NLP, Augmented Search, Visualization) related projects. He practices design thinking techniques for better problem solving

In his free time, he likes playing tennis, attending food & music festivals and watching news.

Read other blogs by Vidur Kaul

These blogs might interest you

by Padmini Sridhar on 28 Jun 2024

by Kedar Bhade on 25 Jun 2024

by Senthil Kumar A L on 24 May 2024

by Arjun Surendra Shravani MR on 3 May 2024

Tag Cloud

Subscribe for blog updates

Technology Focus

News & Events

RESOURCE CENTER

ABOUT HAPPIEST MINDS

Happiest Minds enables Digital Transformation for enterprises and technology providers by delivering seamless customer experience, business efficiency and actionable insights through an integrated set of disruptive technologies: big data analytics, internet of things, mobility, cloud, security, unified communications, etc...

© Happiest Minds 2024 Terms and Conditions Privacy Policy