In the highly evolving landscape of payments, Generative AI is emerging as a transformative technology, revolutionizing the way financial transactions are carried out. Generative AI, a subset of AI holds immense promise in revolutionizing how banking payments are managed, offering solutions that enhance security, streamline processes, and personalize customer experiences. In this blog, we will explore the transformative potential of Generative AI in the payments sector, throwing light on its applications, benefits, and the future it envisions.

Understanding Generative AI

Generative AI primarily involves computers creating new content or data based on patterns and information from existing datasets. In the payments industry, this technology can create innovative solutions and hyper-personalised customer experiences. As digital transactions continue to proliferate, banks face mounting pressure to innovate their payment processing systems to meet evolving customer expectations and regulatory requirements. Generative AI emerges as a game-changing technology that leverages machine learning algorithms to generate new content and insights, enabling banks to address key challenges and capitalize on new opportunities in payment processing. Key components, such as neural networks and deep learning algorithms, are pivotal in its ability to produce realistic and contextually relevant outputs.

Gen AI’s Application in Payments

Hyper-personalized Customer Experiences:

Generative AI can reshape customer experience in payments by providing personalized recommendations, tailored promotions, and responsive virtual assistants that understand user preferences. Gen AI technologies offer very strong foundational capabilities that can be applied across the payment lifecycle to enrich customer experience. Content or data, being the main ingredient, plays a vital role in creating engaging and meaningful experiences across the payment lifecycle. Although this field is still evolving within the technology space, it is evident that banks and financial institutions can strengthen their relationships with customers through hyper-personalization.

Fraud Detection and Prevention:

Generative AI plays a very crucial role in payment security by analyzing vast datasets to identify patterns that can indicate fraudulent transactions. Generative AI models can detect anomalies by creating synthetic data that mimics legitimate transactions. By training the model with both genuine and synthetic data, unusual patterns indicative of fraudulent transactions can be detected. Generative AI can analyze transactional behaviours, such as customers’ interactions with the sellers, purchasing history, etc., to identify deviations from the norm. Its adaptive nature enables continuous learning to stay ahead of evolving threats.

Chatbots and Virtual Assistants:

Generative AI-powered chatbots can be integrated in payment systems, streamlining customer interactions, offering instant support, and facilitating seamless transactions through natural language processing, embedding emotional intelligence into customer conversations.

Automation of Payment Processes:

Generative AI can help automate routine payment processes, minimise manual efforts, negate errors, and improve overall operational efficiency for financial institutions. Using advanced algorithms, AI applications can optimize various stages of payment processing, from payment initiation to reconciliation.

Payments Data Enrichment:

Increased adoption of ISO 20022 message standards requires the banks & financial institutions to convert existing message formats to a structure that is compliant with ISO 20022 and further integrate it into the existing downstream systems like the core banking solution or a payment processing application.

Future Trends and Innovations

Blockchain and Cryptocurrency Integration:

Explore the potential synergy between Generative AI and blockchain technology in the realm of cryptocurrencies, envisioning a future where AI enhances security and efficiency in decentralized financial systems.

Quantum Leap in Biometric Payments:

Anticipate the transformation of biometric payments through Generative AI, envisioning advanced authentication methods that leverage facial recognition, voice analysis, and other biometric data for secure transactions.

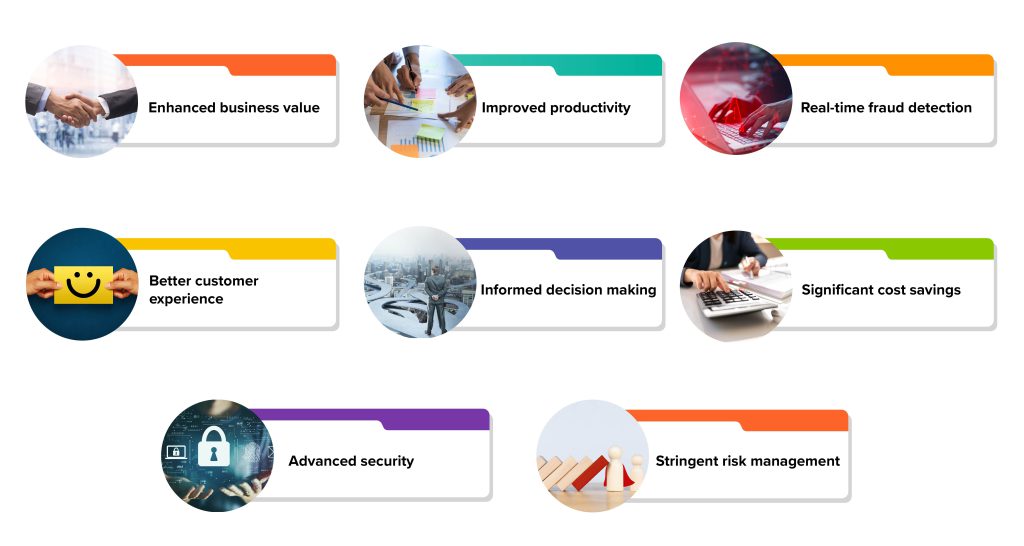

Business Benefits of Generative AI in Payments Industry:

Generative AI holds tremendous potential to transform banking payments, offering solutions that enhance security, efficiency, and customer experiences. By leveraging the power of Generative AI, banks can strengthen their fraud detection capabilities, streamline payment processes, and deliver personalized services to customers, driving innovation and competitiveness in the digital economy. As the adoption of Generative AI continues to expand, banks must remain vigilant in addressing challenges and ethical considerations to ensure responsible and equitable deployment of this transformative technology.

Generative AI is not just a technological advancement but a catalyst for redefining the future of payments. As financial institutions embrace this innovation, they are poised to unlock unprecedented opportunities and elevate the payment experience for users worldwide.

How Can We Transform Your Payments Landscape?

Happiest Minds helps banks and financial institutions capitalize on the opportunities in the rapidly evolving payments industry.

- We transform our clients’ payment landscapes through consulting, agile delivery, transitioning to the cloud, automating testing processes, and partnering with niche payments fintech/vendors to drive the transformation.

- We offer a repository of various payment schemes, policies, procedures, and best practices to assist our clients/ users in understanding the high-level payment schemes of specific geographies.

- ISO 20022 message transformation – a repository containing a summary of ISO 20022 MX messages.

serves as a Domain Consultant Payments within the BFSI, PDES at Happiest Minds, bringing over 18 years of expertise in the banking field. His specialization lies in banking payments solutions and spearheading substantial digital transformation initiatives within the payments arena. At Happiest Minds, Senthil’s key responsibilities include driving business results and providing expert knowledge in banking and payments.