Fintech companies rely primarily on technology to perform the fundamental functions offered by financial services. These companies design sophisticated software, mobile applications, and web applications to enhance the efficiency and accessibility of financial processes for end users.

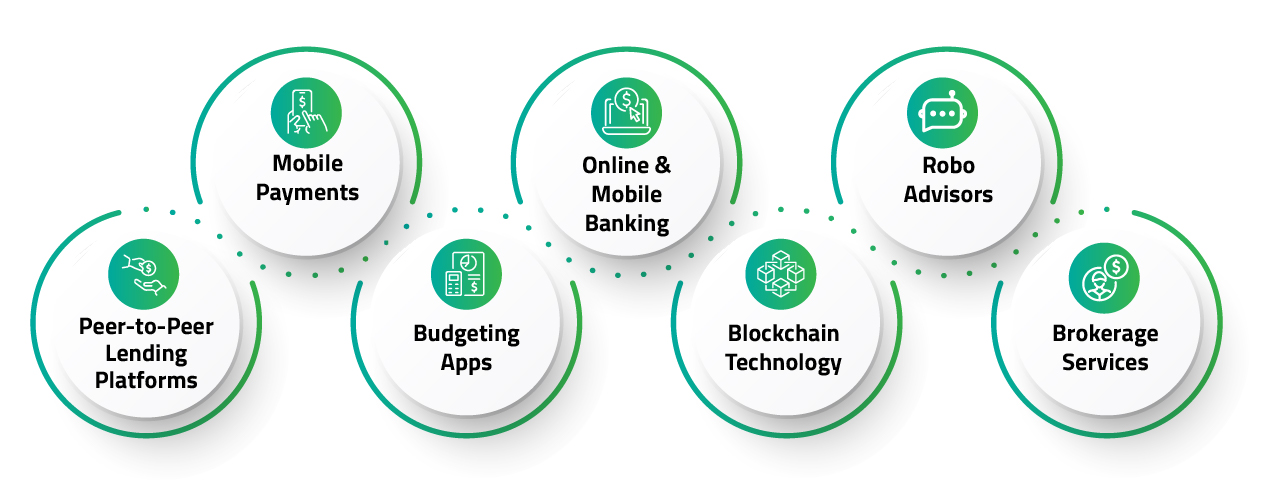

Fintech leads the innovation front in the financial services sector, which has experienced a radical makeover in the recent past. They have transformed the BFSI industry by introducing it to peer-to-peer lending, digital identification, mobile banking, and how an individual can procure a loan.

Let’s look at how fintech and traditional banks interact in the lending marketplace and explore their areas of competition, complementarity, and ultimate customer benefits from this dynamic ecosystem.

Redefining the Lending Experience by Fintech Companies

Fintech has transformed the lending industry by providing fast, digital-first solutions that appeal to underrepresented markets and tech-savvy consumers by:

- Quicker Loan Approval: AI-powered automation speeds up loan processing times by enabling immediate decision-making.

- Enhanced Digital Interaction: Personalized suggestions and frictionless applications are provided by user-friendly systems.

- Increased Accessibility to Finance: Evaluated borrower risk through alternative credit scoring models in place of traditional models, fintech increases access to underserved markets.

Fintech lenders are superior to traditional banks due to their flexibility, reduced overhead costs, quick decision-making, and capacity for quick innovation. Without being burdened by legacy infrastructure, this agility enables them to concentrate on client demands, such as student loans, personal loans, SME loans, and even microlending.

The Traditional Banks’ Response: Adapt or Decline

As a result, traditional banks are no longer just observing; they are aggressively investing in their digital transformation because they understand the challenges that fintech presents. Banks are now modernizing their lending processes by:

- Implementing AI and data analytics to improve credit assessments and create customized lending products.

- Digitizing the loan application process to cut down on paperwork and increase loan approval and disbursement times.

- Enabling the loan application process via mobile apps or omnichannel services.

Traditional banks still have advantages due to a large customer base, regulatory experience, and long-term brand equity. They can also provide a wider range of services compared to fintech including corporate banking, wealth management, trading, forex, and insurance. Thus, banks need to move more quickly.

What Sets Fintech Apart from Traditional Banks?

The main areas of competition between them are speed, personalization, and customer experience.

- Customer Experience: Fintech has enhanced the customer user experience by offering user-friendly mobile apps, quick decision-making engine and efficient procedures. However, traditional banks are still catching up, as many of them are hindered by old customer service solutions and legacy technology.

- Speed: One of the biggest advantages of fintech is its speed. By disbursing loans within minutes or hours rather than days, they have transformed the lending process. This quick turnaround is especially appealing to individuals who are in urgent need of money and to entrepreneurs.

- Personalization: Fintech employs machine intelligence and big data to provide personalized loan packages to clients according to their requirements. With the use of non-traditional data sources such as social media behavior, work patterns, and consumption patterns, fintech can provide loans that are more aligned with the individual profile of each borrower. Banks employ traditional parameters such as credit scores, which may not always reflect the actual financial profile of a borrower.

The Development of Bank-Fintech Partnerships: Moving from Competition to Cooperation

Fintech and traditional banks are increasingly cooperating despite intense competition. As they have their own strengths and weaknesses, banks nowadays are choosing to partner with fintech rather than compete directly with them.

Some of the notable alliances in the lending space are:

- Goldman Sachs and Apple: Apple users can easily access and manage loans on their Apple devices directly by leveraging Goldman Sach’s expertise in lending.

- JP Morgan Chase and PayPal: This partnership enables Chase’s banking ability to be integrated into PayPal’s platform, enabling PayPal consumers to access loan possibilities with ease while increasing Chase’s customer base.

- HSBC and Bud: The collaboration assists HSBC customers in leveraging individualized lending opportunities based on the data accumulated through the union of Bud’s open banking platform.

- Santander and 10x Future Technologies: This partnership allows Santander’s lending solution to be digitized and made more user-friendly through 10x Future Technologies’ cloud-native solution platform, making the loan process more efficient.

These kinds of collaboration indicate that traditional banks and Fintech’s can come together and bring synergies that tap into the strengths of both, bank’s regulatory savvy and stability, combined with fintech’s speed and innovation.

What Does This Mean for Customers?

Ultimately, customers will benefit immensely from the collaboration of traditional banks and fintech in the following ways:

- Increased access to other lending products, with more personalized payment terms and customized interest rates.

- Improved financial services’ efficiency and transparency for customers.

Customers can now pick between traditional banks’ reliability and variety of products or fintech’s quickness and convenience.

The Road Ahead: Compete, Collaborate, or Coexist

Expect a new generation of financial products with financial inclusion as a priority through non-traditional channels like social network-based credit scoring, and best-in-class customer experience. Banks and fintech can compete, collaborate, or coexist, but there is one certainty: technological innovation, customer innovation, and financial inclusion will define the lending business in the future.

is an accomplished professional with over 16+ years of experience in business analysis, consulting, and product management, specializing in the BFSI industry. Skilled in requirements gathering, gap analysis, feasibility studies, and stakeholder management. Proficient in Agile and Waterfall methodologies, with a proven track record of managing projects and implementing solutions within time and cost parameters. Experienced in Loan/Leasing domain, model development, and 3rd party API integration. Adept at driving process improvements and delivering customer-centric solutions.