In the rapidly evolving landscape of the insurance industry, the transformation of traditional business models is paramount. Customers today are not only seeking speed, innovation, and personalized services, but they also expect insurance providers to adapt swiftly to the ever-shifting demographics of consumers in this digital age.

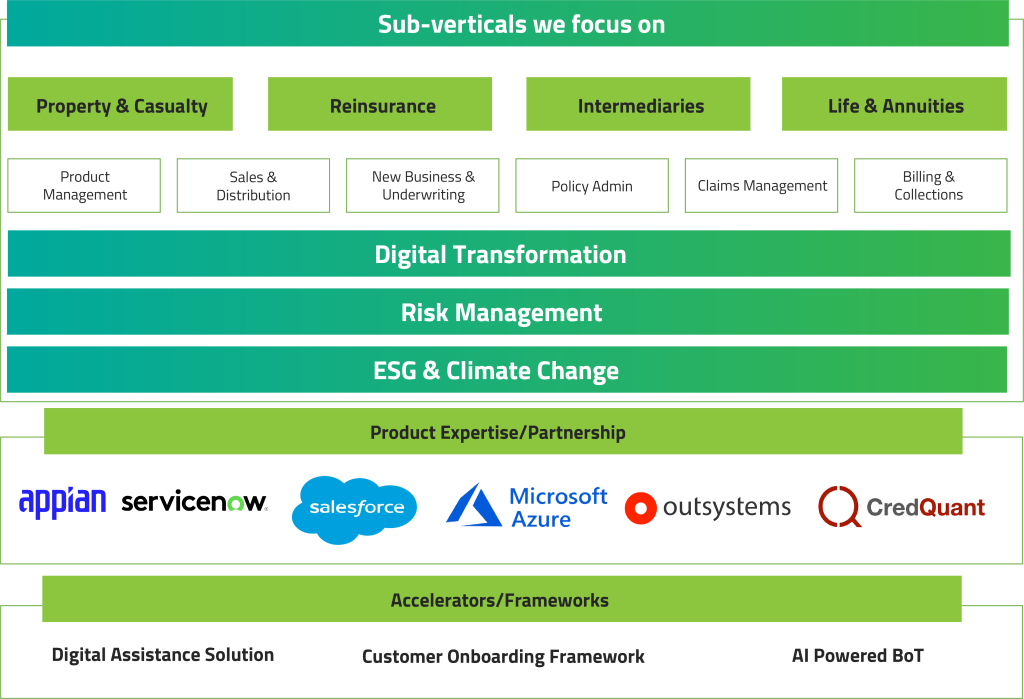

At Happiest Minds, our Insurance IT solutions and services are at the forefront of enabling insurance through next-gen technology in the digital age. We empower your business to not only realize its vision but to do so by harnessing the capabilities of cutting-edge technologies to improve efficiencies, enhance operations, and streamline business processes.

We solve multifaceted problems such as digital adaptation, speed to market, and improving efficiencies. Our deep expertise in disruptive technologies of RPA (Robotic Process Automation), AI (Artificial Intelligence)/ML (Machine Learning), IoT (Internet of Things), LCAP (Low-Code Application Platform), Cloud, Data & Analytics powers our Insurance Technology Consulting Solutions to customize and meet your business goals.

Disclaimer: All logos are the property of their respective owners