Despite rising concerns over data security and privacy, increased convenience offered by digitalisation continues to drive the proliferation of these technologies. Today’s digital native customers expect organizations to deliver a flexible, omni-channel, standardized, transparent, and hassle free on boarding experience. Creating differentiation through enhanced customer acquisition and on boarding requires that organizations must enable intelligent automation to forego manual intensive, fragmented, and paper processes.

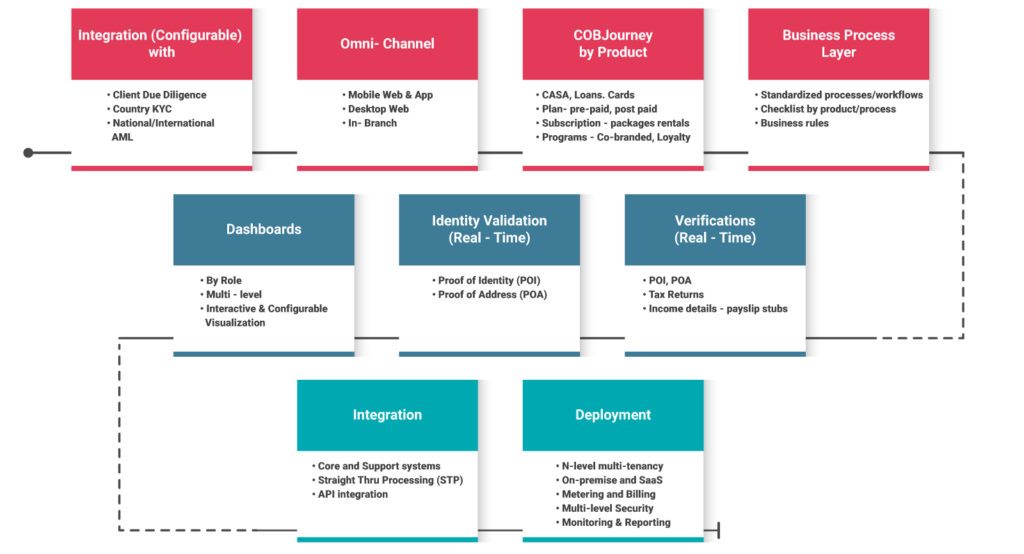

Happiest Minds Digital Customer On Boarding (dCOBTM) solution is an artificial intelligence powered platform which enables organizations to implement omni-channel and disruptive capabilities like real-time bio-metric verification, social profile, and personality insights. The solution can be implemented for B2C as well as B2B organizations across various industries such as banking, financial services and insurance, retail, telecom, and technology. dCOBTM empowers organizations to:

- Eliminate digital identity challenges that impede future on boarding initiatives.

- Leverage emerging technologies like AI/ML and intelligent automation to minimize risks and enhance security.

- Enable zero data entry on boarding.

- Seamlessly integrate back-end systems to allow hassle free data validation and verification.

- Provide a personalized portal to customers with inbuilt cognitive chatbot capabilities.

- Offer visibility at each step of the complete on boarding process.

- KYC-AML compliant configurable, intelligent, Workflows.

Digital Customer On Boarding (dCOB™) solution digitally disrupts the existing disconnected customer on boarding process by smartly leveraging digital technologies, national databases, and enterprise systems.